Individuals seeking to replace lost social security, pension or wage income at the death of the recipient in favor of their beneficiary will find a reversionary annuity a most capable product. However, it’s difficult to find much written about reversionary annuities. They are not covered in annuity technical literature because they are really life insurance policies. Reversionary annuities derive their name from what they do not from what they are. In simple terms, a reversionary annuity is a life insurance policy that pays a lifetime income to the policy beneficiary when the insured dies. The sole purpose of a reversionary annuity is income replacement, and because of how it’s actuarially designed, it does a better job at less cost than universal or whole life insurance. While a reversionary annuity doesn’t have “cash” equity like universal or whole life, it is an “equity” policy design because after a period of premium payment years, policyholders start to vest, up to 100%, in the monthly beneficiary income payments. So, unlike universal or whole life policyholders, and after a period of time, a reversionary annuity can’t lapse without value.

Individuals seeking to replace lost social security, pension or wage income at the death of the recipient in favor of their beneficiary will find a reversionary annuity a most capable product. However, it’s difficult to find much written about reversionary annuities. They are not covered in annuity technical literature because they are really life insurance policies. Reversionary annuities derive their name from what they do not from what they are. In simple terms, a reversionary annuity is a life insurance policy that pays a lifetime income to the policy beneficiary when the insured dies. The sole purpose of a reversionary annuity is income replacement, and because of how it’s actuarially designed, it does a better job at less cost than universal or whole life insurance. While a reversionary annuity doesn’t have “cash” equity like universal or whole life, it is an “equity” policy design because after a period of premium payment years, policyholders start to vest, up to 100%, in the monthly beneficiary income payments. So, unlike universal or whole life policyholders, and after a period of time, a reversionary annuity can’t lapse without value.

Another difference is a reversionary annuity incorporates a medical underwriting for both the insured and the beneficiary. This dual underwriting is one reason why policyholder premiums are cheaper or policies provide larger income death benefits, depending on the case, than traditional life insurance.

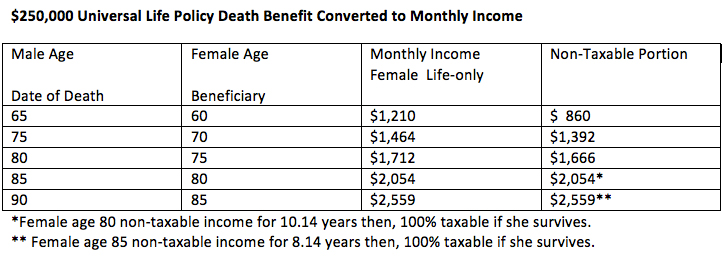

Utilizing a no-lapse guarantee to age 100 universal life policy, and looking at a current $7,200 annual premium pricing for a male, age 65 insured (standard) and a female, age 60 beneficiary (standard) for a $250,000 death benefit, the following guaranteed monthly incomes are produced depending on when the insured dies. All table monthly incomes are lifetime-only immediate annuities paid on the female’s life. Because, I can’t know future annuity rates, I used current rates at the time of writing.

If the insured dies the day after purchasing the universal life policy, and if the entire $250,000 death benefit is utilized for lifetime income, it can only purchase a monthly income of $1,210 for the female, now age 60. The amount of lifetime annuity income grows over the years because the $250,000 death benefit is fixed and because the female gets older and older at each assumed males’ date of death, the possible lifetime annuity income becomes greater and greater as they both age together.

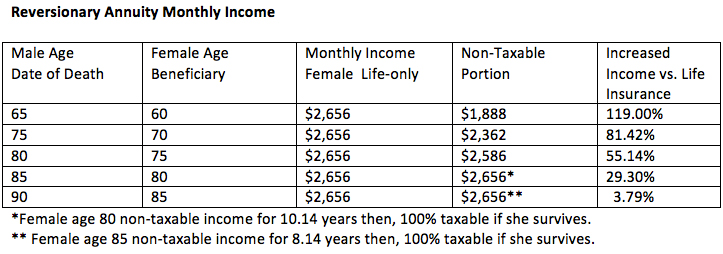

Let’s look at the income death benefit of a reversionary annuity assuming the same male/female facts. The reversionary annuity premium is the same, $7,200 per year. What will that get you (see table below).

For exactly the same $7,200 annual premium cost, look at the males’ age 65 date of death when the female beneficiary is age 60. If he happens to die just after purchasing the reversionary annuity, the female beneficiary’s reversionary annuity monthly income of $2,656 produces a whopping 119% more guaranteed monthly lifetime annuity income than the income generated by the universal life insurance policy. In fact, on a guaranteed basis, in this example, you would have to go way out past the males age 90 before the life insurance policy will out produce the reversionary annuity as a guaranteed lifetime income provider to this female.

Keep in mind, because the reversionary annuity beneficiary is medically underwritten, unhealthy beneficiaries will either produce a lower premium cost or an increased monthly income depending on your case. This is a very different treatment than traditional life insurance policies that don’t consider the health of the beneficiary in the premium pricing or death benefit costs.

The reversionary annuity has post-issue benefits vs. traditional life insurance as well. For one, because the reversionary annuity has no cash value, a third party can’t compel the policy owner to surrender the policy for the cash value it doesn’t have. A second benefit is; since the beneficiary is part of the policy underwriting no one can compel the substitution of the beneficiary for another individual or entity. Because of policy language, the beneficiary can’t be compelled to assign their income benefit. In all regards, reversionary annuities provide much more certain post issue disposition outcomes vs. traditional life insurance policies.

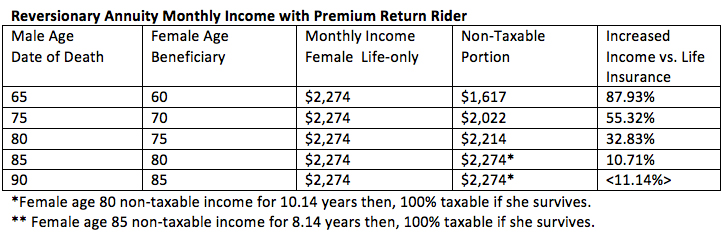

Because the reversionary annuity beneficiary is part of the policy underwriting, what happens if the beneficiary pre-deceases the insured? Normally, the reversionary annuity terminates without further value so; there is a potential cost to this increased monthly income benefit vs. what can be provide for with traditional life insurance. Because of this reason, and to make this policy more attractive to the insured, a rider can be purchased, at the time of application that will pay all the paid premiums to the insured as a reverse beneficiary in the form of a life contingent monthly income over a period of 10-years or 120 months. In other words, the insured, now the reverse beneficiary, has to survive all 10 years in order to receive a full return of paid premium. The insured’s death prior to this time terminates the unpaid return of premium. Let’s see how this rider cost reduces the reversionary annuity beneficiary’s lifetime monthly income.

Even with the return of premium rider feature the reversionary annuity, on a guaranteed basis, substantially out produces the universal life policy lifetime income possibilities, in this example, and it’s only at or approaching the insured’s age 90 does the universal life policy begin to indicate superior results.

Now, you are always going to need traditional life insurance death benefit protection for paying off household debts, college tuition costs, business partner buy-outs, charitable bequests, estate taxes, etc. But as far as income replacement and product permanency goes, reversionary annuities are the king. Hail to the king baby!