An annuity mortality pool is the collection of all individuals who purchase life contingent annuity contracts from a life insurance company. Most individuals and agents believe, in order to join this pool and to obtain the mortality discounts these contracts offer for better annuity pricing, they are required to purchase annuity contracts supporting life contingent payments out to age 120 or there-a-bouts. These payments typically are supported by joint and survivor, single life or period certain and lifetime annuity contracts. These contracts can be costly because they support payments for the entire lifetime of the annuitant(s).

An annuity mortality pool is the collection of all individuals who purchase life contingent annuity contracts from a life insurance company. Most individuals and agents believe, in order to join this pool and to obtain the mortality discounts these contracts offer for better annuity pricing, they are required to purchase annuity contracts supporting life contingent payments out to age 120 or there-a-bouts. These payments typically are supported by joint and survivor, single life or period certain and lifetime annuity contracts. These contracts can be costly because they support payments for the entire lifetime of the annuitant(s).

However there is another, cheaper way to obtain mortality pricing by joining the mortality pool for only a limited duration of time say five or ten years, for example. In this manner, you are just tipping your toe into the mortality pool, testing the waters, prior to deciding if you want to jump in all-the-way or not. The annuity that permits this is called a temporary life annuity. A temporary life annuity is a way of obtaining some mortality pool pricing that increases annual annuity income for the fraction of the costs of purchasing a more common lifetime annuity.

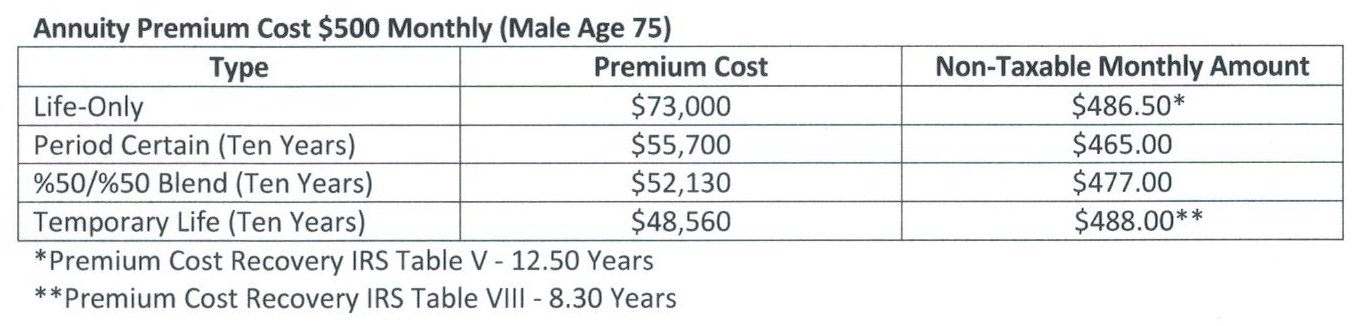

Let’s look at the current premium costs for a male age 75 that wants to take advantage of mortality pricing (mortality credits) but doesn’t want to commit a ton of capital/premium. He wants a $500 monthly income starting 30 days after the purchase date.

A full lifetime “straight life” annuity premium cost is $73,000. A temporary life annuity for ten years premium cost is $48,560. While each annuity produces the same $500 monthly income, the temporary life annuity premium cost is only 66.50% of the full lifetime straight life annuity because it pays over a shorter duration. A period certain annuity with the same ten year duration costs $55,700.

Some agents and clients may be put-off by a strictly life contingent annuity. If this is the case, the best way to use temporary life is to incorporate period certain contracts by dividing the overall annuity premiums. For example; a 50% income blend of each period certain and temporary life produces a premium cost is $52,130 (see table).

Since this temporary life annuity can’t exceed a payment of duration of ten years, the premium cost is lower vs a full lifetime or period certain annuity with the same duration. After ten years, the client may elect to make an additional purchase now with better mortality pricing available to individuals age 85. If interest rates improved and mortality estimates remained unchanged his premium cost will be reduced. If he dies during the initial ten years after making the age 75 purchase, his estate is only out the premium cost for the temporary life annuity ($48,560) and not the premium cost for the full lifetime annuity ($73,000) at age 75. In the case of the 50% income blend, his estate is only out the temporary life cost ($24,280) with the period certain contract paying his beneficiary(s).

Temporary life annuities permit owners to reduce annuity premium costs for some portion of their incomes while retaining flexibility to make future annuity purchases when pricing might improve. In this ultra-low interest rate environment, temporary life annuity contracts can easily be mixed with other assets and SPIAs to add that extra income push to help retirees get past the income hump.

Notes

Mettler, Gary S. 2005. “What is a Temporary Life Immediate Annuity, Anyway?” White Paper publication, available upon request.